| Which types of securities are eligible for Closing Auction Session (CAS)? |

| i) |

Major index constituent |

| - |

Constituent stocks of Hang Seng Composite LargeCap and MidCap indexes H shares which have corresponding A shares listed on Mainland securities exchanges |

| - |

H shares which have corresponding A shares listed on Mainland securities exchanges |

| ii) |

All ETFS |

| iii) |

Constituent stocks of Hang Seng Composite SmallCap index |

Back to top |

| What is the trading hours for CAS? |

| |

Full Day Trading |

Half Day Trading |

| Reference Price Fixing Period |

16:00 – 16:01 |

12:00 – 12:01 |

| Order Input Period |

16:01 – 16:06 |

12:01 – 12:06 |

| No Cancellation Period |

16:06 – 16:08 |

12:06 – 12:08 |

| Random Closing Period |

16:08 – 16:10 |

12:08 – 12:10 |

Typhoon arrangement:

If Typhoon Signal No. 8 or above is hoisted before 15:45 (for full day trading) or 11:45 (for half day trading), trading will terminate 15 minutes after the hoisting of the Signal. There will be no CAS for that trading day if trading has not been resumed by 15:45 (for full day trading) or 11:45 (for half day trading).

If Typhoon Signal No. 8 or above is hoisted at or after 15:45 (for full day trading) or 11:45 (for half day trading), trading for the day will continue as normal until the end of the CAS.

Back to top |

| How does CAS works? |

| 16:00 – 16:01 |

16:01 – 16:06 |

16:06 – 16:08 |

16:08 – 16:10 |

Reference Price Fixing Period

(1 min) |

Order Input Period

(5 mins) |

No-Cancellation Period

(2 mins) |

Random Closing Period

(2 mins) |

| - |

Calculate & publish reference price |

| - |

Input new ALO in CCBA in this period is allowed, but it may be rejected by market when the relevant reference price is fixed. |

| - |

The outstanding orders in Continuous Trading Session (CTS) which are within the allowable price limit (i.e. (+/- 5% from the reference price) will be automatically carried forward to CAS | |

Price limit allowed: |

| +/- 5% of reference price |

Within lowest ask & highest bid |

| Order type allowed in CCBA: |

| At-auction Limit order (ALO) |

| Order input, Cancellation & Amendment |

| Allowed input, cancel and amend |

Input allowed, cancel and amend not allowed |

| * |

Price spread checking on ALO in CAS: |

| - |

Allowable price limit (if applicable ) or 200 spreads or 9 times from the nominal price (whichever is lower) |

|

- Reference Price Fixing Period: The reference price is determined by HKEx by taking the median of 5 nominal prices in the last minute of the CTS. During this period, the reference price is not available. You can input your ALO through CCBA system but it will be stored in the Bank’s system and passed to the market during the Order Input Period.

- Order Input Period: Only At-auction Limit Order (ALO) within the +/-5% of the reference price can be input. The ALO which is input during the Reference Price Fixing Period will be delivered to market. However, the order may be rejected by market if the price is out of the allowable price limit (within the +/-5% of the reference price). Please be reminded to check the order status in “Order Status / Order History” section of Online Banking or Mobile Banking after order input. Outstanding orders can also be amended or cancelled during this period.

- No Cancellation Period: Only ALO with the price between the lowest ask and highest bid recorded at the end of Order Input Period can be input, and no orders can be amended or cancelled.

- Random Closing Period: Market closes randomly within the last 2 minutes of CAS. After the period, there’s order matching for all CAS securities.

(To know more about the CAS, you may also refer to HKEx website

Back to top |

| How does the order matching mechanism works? |

After the end of Random Closing Period, orders are matched according to order type (at-auction order with higher priority than at-auction limit order), price and time priority at the final Indicative Equilibrium Price (IEP) (i.e. Closing Price).

If final IEF cannot be determined at the end of the CAS, reference price will become the final IEP. In this case, at-auction orders and at-auction limit orders with price at or better than the reference price will be matched at the reference price.

If both IEP and reference price cannot be determined, then there will be no automatic order matching.

Back to top |

| How the outstanding orders in CTS will be handled? |

For orders with the order status 'queued' in "Order Status" section of our Mobile Banking and the order price falls within the allowable price limit (+/-5% from reference price), the orders will be automatically carried forward to CAS.

For the order with the order status 'queued' in "Order Status" section of our Mobile Banking whereas the order price falls outside the allowable price limit (+/-5% from reference price), the order will not be carried forward to CAS automatically unless the order price is modified and falls within allowable price limit by customer during Order Input Period (16:01 – 16:06) of CAS.

Back to top |

| How the unfilled / partially filled orders will be handled after CAS? |

For Day order: Order of CAS Securities which have not been filled / partially filled will lapse after CAS close.

For Good-till-date (GTD) order: Order of CAS Securities which is unfilled / partially filled during CAS will be automatically carried forward to the next trading day until it is triggered or cancelled or expired.

Back to top |

| Volatility Control Mechanism |

| Which types of securities / derivatives are covered by the Volatility Control Mechanism (VCM)? |

The scope of securities / derivatives in VCM covers Hang Seng Index (HSI) and Hang Seng China Enterprise Index (HSCEI) constituent stocks and the related index futures contracts.

Back to top |

| Which trading session(s) that VCM will be triggered? |

VCM is applicable during Continuous Trading Session (CTS) except the first 15 minutes of the morning and afternoon CTS and the last 15 minutes of the afternoon CTS. VCM will only last for 5 minutes and it will be triggered 1 time in each trading session for each stock / derivative and no VCM monitoring for the relevant stock / derivative within the same CTS. If morning session of CTS closes before the end of cooling off period, the remaining time of the cooling off period will not be brought forward to afternoon session of CTS.

For market open is delayed due to typhoon signal No. 8 or above is hoisted or black rainstorm, first 15 minutes after market open will still not subject to VCM.

For early market close due to typhoon signal No. 8 or above is hoisted during the trading hour, VCM can still be triggered in the last 15 minutes before market close and continue until market close.

Back to top |

| How does the VCM work? |

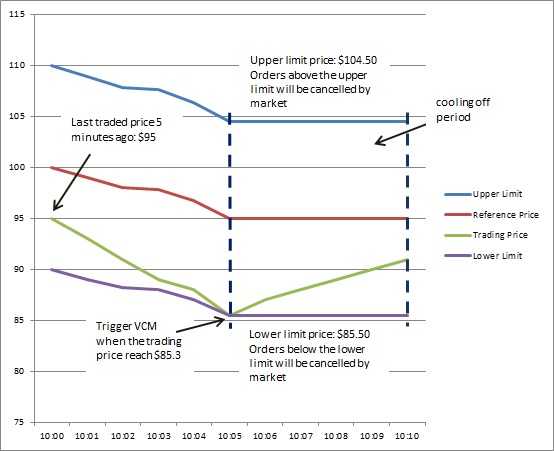

If the market tries to trade VCM's stocks at a price of more than 10% away from its last traded price 5 minutes ago ("Reference Price"), VCM is triggered (last for 5 minutes). During this cooling-off period, the affected stock will be only allowed to trade within a fixed band of +/- 10% from the Reference Price and only those orders with input price within the fixed band will be accepted.

When VCM is triggered, the orders which trigger the VCM and the outstanding orders which are queued in the market for matching (the order status of such order is 'queued' in the Bank) and the price is set outside the fixed band will be rejected by the market immediately. A SMS notification for rejection will be sent to customers' mobile if the order is placed via our automated trading platform (e.g. Online Banking or Mobile Banking). Customer can also enquire the order status at "Order Status" section of Mobile Banking or via our Securities Trading Hotline.

(To know more about the VCM, please refer to the website of HKEx https://www.hkex.com.hk/vcm/en/index.htm)

Back to top |

| How the reference price of VCM being determined? |

The reference price should be the last price executed 5 minutes ago. If there is no trade execution 5 minutes before, system will further search backward for the latest last traded price as reference price. This search can go backward till market open where the auction price established during the Pre-opening Session will be used as reference price.

If there is no trade execution from market open to 5 minutes before the start of VCM monitoring, system will use the first traded price as the reference price until there is subsequent execution.

Back to top |

| eIPO |

| What is eIPO Service? |

IPO stands for Initial Public Offering that is the first time a company issues shares or bonds to public investor. The newly issued securities or bonds may be listed on stock exchange. eIPO service means a service offered by the Bank of subscription for new issued shares through internet.

Back to top |

| What are the benefits of eIPO? |

| 1. |

Time Saving:

No more queuing up in long lines to obtain or submit application forms or write checks for IPO subscriptions. |

| 2. |

Reliable:

Deposit your allotted shares directly into your securities trading account with us to avoid any delay or loss of certificates in the mail. |

| 3. |

Fast:

Instant trading of the allotted shares on the first trading day. |

Back to top |

| Pre-registration is required for eIPO Service? |

Customers who use our eIPO Service should maintain securities account and Online Banking and Mobile Banking Service with our Bank.

Back to top |

| How to make application payment? |

Payment of application money will be made by direct debiting to your settlement account on or after payment deadline. However, please ensure you have sufficient fund in your settlement account on or before the payment deadline. Otherwise, your application will not be processed.

Back to top |

| Is eIPO Service available 24 hours a day? |

Yes. You may submit application online anytime between the eIPO Application Starting Date and Application Deadline that can be found at the eIPO Center of our Bank.

Back to top |

| What are the steps of using eIPO Service? |

| Step 1 |

Read carefully any information about the new issued shares by logging on our Mobile Banking >Investment Page > IPO Stock. |

| Step 2 |

Before making an application, read thoroughly and agree with all the "Terms & Conditions for eIPO Services"; |

| Step 3 |

Reading carefully the Prospectus relating to the IPO company and all other relevant Terms and Conditions. |

| Step 4 |

If you agree with all the terms and conditions, you can complete the online application form.

Once you confirmed the application, you cannot amend or cancel your application. Please check the information carefully and ensure that the information provided by you is correct.

After the Bank has received an online instruction, a confirmation of receipt of instruction with the reference number assigned for such instruction will be posted. The Applicant is advised to keep the reference number of such confirmation for record.

Payment of application money will be made by direct debiting to your settlement account. |

| Step 5 |

Your allotted securities will be deposited into your designated securities account on the first listing (issue) day, which allow you to take actions instantly according to market conditions. Refund of Application Money will be credited back to your settlement account within the days specified in the prospectus. |

Back to top |

| Can I submit more than one application for the same IPO? |

No. The applicant should submit only one application; The Bank shall not process any instruction by reason of multiple applications.

Back to top |

| Which applications form eIPO Service is like? |

eIPO Service form is like yellow application form. The Bank in the name of your nominee submits application for you. All the payment of application money will be debited to the settlement account through Auto-Pay Method. Your allotted securities will be deposited into your designated securities account. And refund of Application Money (If any) will be credited back to your settlement account.

Back to top |

| How do I know if my application instruction has been submitted successfully? |

After the Bank has received an online instruction, a confirmation of receipt of instruction with the reference number assigned for such instruction will be posted on relevant webpage. The Applicant is advised to print and keep a hard copy of such confirmation for record. Moreover, please ensure you have sufficient fund in your settlement account on or before the payment deadline. Otherwise, your application will not be processed.

Back to top |

| Can I amend or cancel my eIPO application? |

No. Once you confirmed the application, you cannot amend or cancel your application.

Back to top |

| How do I know whether the securities are allotted to me? |

Your allotted securities will be deposited into your designated securities account on the first listing (issue) day. Allocation, and arrangements for announcing the results of the allocation, of securities shall be the sole responsibility of the Offeror and should be specified in the prospectus or the relevant offering documents issued in respect of the relevant Public Offer.

Back to top |

| How will I be refunded? |

If you receive allotted shares with partially successful or unsuccessful, the application of money will be credited back to your settlement account within the days specified in the respective prospectus.

Back to top |

| FX Linked Deposit |

| What is the minimum deposit amount? |

The minimum deposit amount is USD10,000 or equivalent.

Back to top |

| What is the maximum deposit amount? |

The maximum deposit amount is USD250,000 or equivalent.

Back to top |

| What currency pair combinations are available? |

You may choose any currency combinations between HKD or USD and EUR, JPY, AUD, NZD, CAD, GBP, CHF.

Back to top |

| Is there any subscription charge for FX Linked Deposit displacement online? |

No.

Back to top |

| What are the service hours for FX Linked Deposit displacement through Mobile banking? |

Please refer to the FX Lined Deposit Placement in Online Banking Service Time Table.

Back to top |

| How do I place FX Linked Deposit? |

To place a FX Linked Deposit, go to "Investment", select "FX Linked Deposit" and then "FXLD Placement". Fill in the required information, get the updated rate and choose your initial exchange rate.

Back to top |

| Can I cancel the deposit after booking? |

After confirmation of FX Linked Deposit displacement, the deposit cannot be cancelled until maturity.

Back to top |

| How do I know the repayment amount and currency of the FX Linked Deposit booking on maturity date? |

Set up FX Linked Deposit Maturity eAlert via Online/Mobile Banking and you will receive notification via SMS upon maturity.

Back to top |

| Will I receive an advice for FX Linked Deposit online booking? |

Yes, you will receive a transaction advice.

Back to top |

| How long will my placement history be available? |

Each placement record will be available for 3 months on Online/Mobile Banking.

Back to top |

| When will the fixing exchange rate will updated in "Placement History" under "FX Linked Deposit"? |

For FX linked deposit placed at Online/Mobile Banking, the fixing exchange rate will be updated at around 3:00 pm on the fixing date.

For FX linked deposit placed at branch, fixing exchange rate will be updated on the next business day after the fixing date.

Back to top |

| Why can't I see the FX Linked Deposit placed today in "Portfolio" under "FX Linked Deposit"? |

|

The FX Linked Deposit will be shown on Online/Mobile Banking one business day after the Deposit Start Date.

Back to top |

| Gold Trading |

| What is the minimum trading unit? |

The minimum trading unit is one ounce.

Back to top |

| Are there any trading limits? |

The maximum trading amounts are HKD2,000,000 per transaction and HKD6,000,000 per day.

Back to top |

| Are there any service charges for Gold Trading? |

No.

Back to top |

| What are the service hours for online Gold Trading? |

Please refer to the Gold Trading in Online Banking Service Time Table.

Back to top |

| How do I trade Gold? |

To trade Gold, go to "Investment" → "Gold Trading" → "Buy/Sell".

Back to top |

| How can I check my order status? |

To check your order status, please access "Investment" → "Gold Trading" → "Order Status". Orders submitted online will be available only.

Back to top |

| Will I receive an advice for online Gold Trading? |

Yes, you will receive a transaction advice.

Back to top |